Decoding The 10 Year Treasury Note Your Ultimate Guide

Lead: In the intricate world of finance, few indicators hold as much sway as the 10-year Treasury note. Often referenced in economic reports and market analyses, its yield serves as a critical barometer for everything from mortgage rates to global investor sentiment. This comprehensive guide delves into decoding the 10-year Treasury note, offering an ultimate resource for understanding its profound importance and far-reaching implications. Readers will gain crucial insights into why this seemingly simple government debt instrument is a cornerstone of the financial landscape and how its movements directly influence economic stability and personal financial decisions.

What Is Decoding the 10-Year Treasury Note?

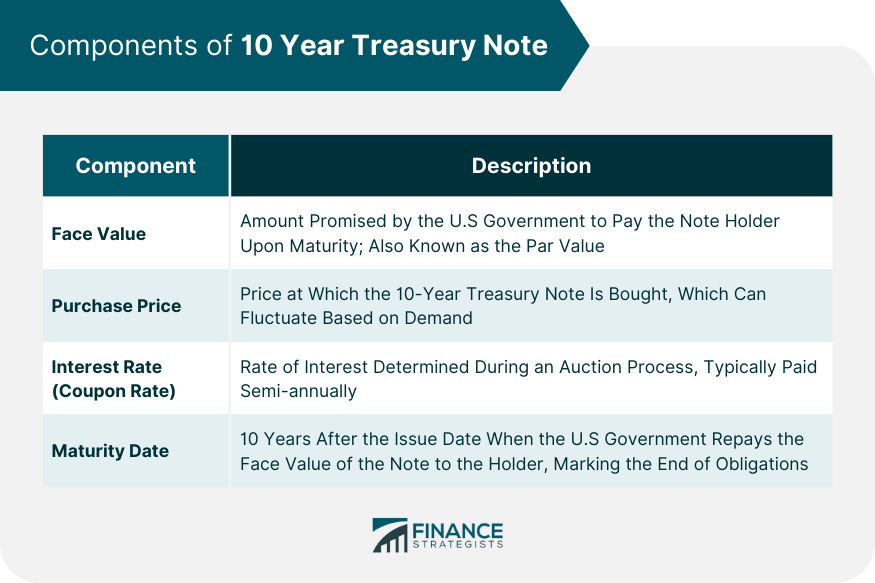

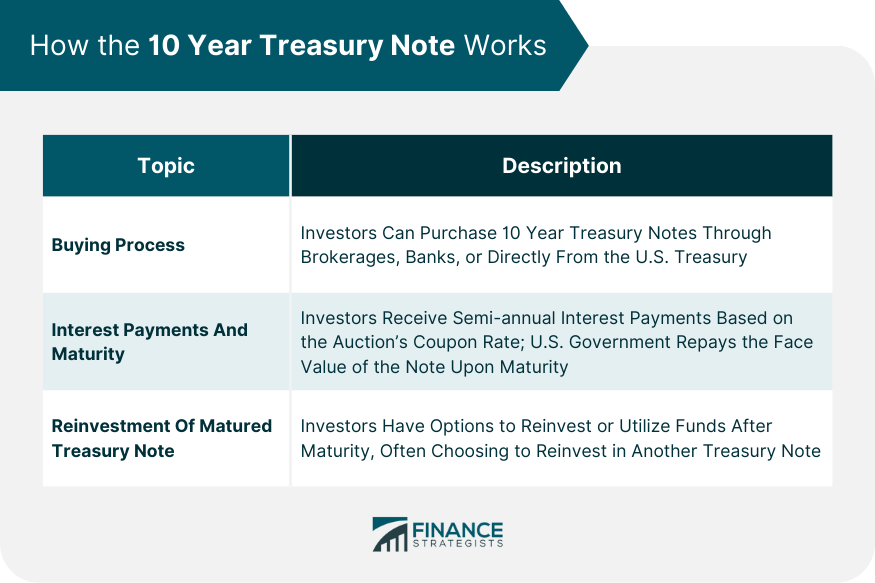

Decoding the 10-year Treasury note fundamentally involves understanding its nature as a debt security issued by the U.S. Department of the Treasury. It represents a loan made by an investor to the U.S. government, which promises to pay fixed interest payments (coupon payments) over a decade, returning the principal amount upon maturity. The "decoding" aspect refers to interpreting its yieldthe return an investor receivesas a signal for broader economic conditions and future interest rate expectations. Unlike its price, which moves inversely with yield, the yield itself is the figure widely quoted and analyzed.

- U.S. Government Debt: A primary method for the U.S. government to finance its spending.

- Fixed Interest Payments: Provides investors with predictable income streams over its 10-year life.

- Benchmark for Other Rates: Its yield serves as a reference point for various other interest rates, including mortgages, corporate bonds, and auto loans.

- Safe-Haven Asset: During times of economic uncertainty, investors often flock to Treasury notes due to their perceived safety, backed by the full faith and credit of the U.S. government.

Why Decoding the 10-Year Treasury Note Is Trending

The 10-year Treasury note is perpetually trending due to its pivotal role as a benchmark for financial markets worldwide. Its yield movements are under constant scrutiny by economists, investors, and policymakers, especially during periods of economic flux, inflation concerns, or shifts in monetary policy by the Federal Reserve. Any significant rise or fall in the 10-year Treasury yield can trigger broad market reactions, influencing everything from the affordability of housing to the valuation of equities. Its continuous relevance stems from its ability to reflect real-time expectations about economic growth, inflation, and the future path of interest rates, making it a crucial data point in virtually every financial news cycle.

Key Details of the 10-Year Treasury Note

The 10-year Treasury note is not an "event" in the traditional sense, but a continuous and dynamic financial instrument. It is regularly issued by the U.S. Treasury through public auctions, ensuring a constant supply to meet market demand. Its yield is not set by the government but is determined by the interplay of supply and demand in the highly liquid secondary market. This global market operates almost 24/7, with institutional investors, central banks, and individual investors constantly trading these notes. Key figures and institutions that influence or closely monitor the 10-year Treasury yield include the Federal Reserve, the U.S. Treasury Secretary, and major investment banks, all of whom interpret its signals for their respective strategies and policies.

How To Monitor and Understand the 10-Year Treasury Note

For those seeking to understand or track the 10-year Treasury note, practical insights involve consistent observation and a grasp of its interconnectedness with broader economic indicators. Monitoring its movements provides a window into market sentiment and economic expectations.

- Follow Reputable Financial News: Major financial outlets like Bloomberg, The Wall Street Journal, and Reuters provide daily updates and in-depth analyses of Treasury yields.

- Access Real-Time Market Data: Platforms such as Yahoo Finance, Google Finance, and dedicated brokerage platforms offer real-time yield data for the 10-year Treasury note, often presented as "US10Y" or similar tickers.

- Understand Economic Indicators: The yield is heavily influenced by economic reports on inflation (e.g., Consumer Price Index - CPI), employment, manufacturing, and consumer confidence. Grasping these connections is crucial.

- Track Federal Reserve Statements: The Federal Reserve's monetary policy decisions and communications regarding interest rates directly impact bond yields. Following their meetings and press conferences provides significant context.

- Consult Financial Professionals: For investment-specific implications or personalized advice, consulting with a qualified financial advisor can help interpret how Treasury movements affect individual portfolios.

What To Expect From Understanding the 10-Year Treasury Note

- Insight into Bond Yields and Prices: A clear comprehension of the inverse relationship between bond prices and yields, a fundamental concept in fixed income investing.

- Impact on Mortgage Rates and Consumer Loans: An understanding of how the 10-year Treasury yield often sets the baseline for long-term borrowing costs, directly affecting home loans, auto loans, and other consumer credit.

- Indicator of Economic Health and Investor Sentiment: The ability to interpret rising or falling yields as signals of economic expansion, contraction, inflationary pressures, or periods of investor risk aversion.

- Influence on Stock Market Valuations: Recognition of how higher Treasury yields can make bonds more attractive relative to stocks, potentially impacting equity market performance, particularly growth stocks.

The Broader Impact of Decoding the 10-Year Treasury Note

The influence of the 10-year Treasury note extends far beyond simple investment portfolios. It acts as a primary global benchmark, guiding capital allocation decisions by institutional investors and corporations worldwide. Its yield heavily impacts monetary policy decisions, as central banks often consider its movements when setting their own interest rates. Furthermore, it influences corporate bond markets, as companies must offer higher yields than risk-free Treasuries to attract investors. On an international scale, the 10-year Treasury note reflects confidence in the U.S. economy and the stability of the dollar, affecting international capital flows and currency valuations. Its status as a safe-haven asset means its performance can be a bellwether for global economic stability.

The 10-year Treasury yield is often called the 'most important number in the world' for a reason; its fluctuations ripple through every corner of the financial system, from government policy to household budgets.

Economic or Social Insights

From an economic perspective, decoding the 10-year Treasury note offers immediate insights into inflation expectations and the market's outlook on future economic growth. A rising yield can signal expectations of stronger economic activity and potentially higher inflation, while a falling yield might suggest economic slowdown or a flight to safety. Its movements are closely watched in fiscal policy debates, influencing the cost of government borrowing and the feasibility of various spending programs. For the average citizen, understanding its implications is crucial, as it directly translates into changes in borrowing costs for housing, education, and business investments. Economic publications such as Business Insider and The Economist frequently cite the 10-year Treasury yield in their analyses of market trends and economic forecasts, underscoring its broad relevance.

Frequently Asked Questions About Decoding the 10-Year Treasury Note

- What is decoding the 10-year Treasury note? Decoding the 10-year Treasury note involves understanding this medium-term debt obligation issued by the U.S. Treasury, which matures in 10 years and offers fixed interest payments. The "decoding" refers to interpreting its yield as a key indicator of market sentiment, economic growth, and future interest rates.

- Why is the 10-year Treasury note popular? Its popularity stems from its yield serving as a crucial benchmark for a wide range of consumer and corporate borrowing rates, including mortgages. It is also highly regarded as a safe-haven asset and a reliable barometer of broader economic expectations, making it a focal point for financial analysis.

- How can people participate or experience it? Participation involves monitoring financial news and economic data sources, analyzing the yield's movements, and understanding its implications for personal finance and investment strategies. Individuals can indirectly "experience" its impact through changes in borrowing costs and market conditions.

- Is it legitimate or official? Yes, the 10-year Treasury note is an entirely legitimate and official debt instrument issued by the U.S. government, backed by its full faith and credit. It is a cornerstone of global financial markets.

- What can attendees or users expect? Individuals who learn to decode the 10-year Treasury note can expect to gain valuable insights into market sentiment, inflation outlooks, and future interest rate trajectories. This understanding enhances financial literacy and informs better decision-making in personal and investment finance.

Conclusion

The 10-year Treasury note is far more than just a government bond; it is a vital economic signal, a global benchmark, and a direct influencer on the financial well-being of millions. Its continuous movement and the narratives derived from its yield are indispensable for comprehending the current state and future trajectory of the economy. Understanding how to decode this critical instrument equips individuals with a powerful tool for navigating the complexities of the financial world, making informed decisions, and appreciating the intricate dance between government policy, market forces, and everyday economic realities. Its consistent prominence underscores its enduring significance as a pillar of financial analysis.